Relief Coming: Gov’t to Scrap COVID Levy and Fix VAT

COVID-19 Levy to Be Abolished as Ghana Overhauls VAT

Ghana’s government has unveiled plans to scrap the COVID-19 Health Recovery Levy and review the VAT system to ease pressure on small businesses and consumers.

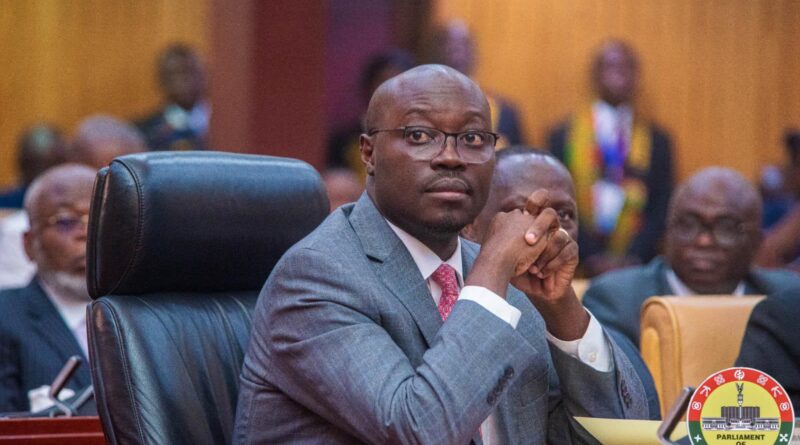

Finance Minister Dr. Cassiel Ato Forson announced the 2025 Mid-Year Budget Review in Parliament on July 24.

VAT to Be Simplified and Made Fairer

Dr Forson said the effective VAT rate would be reduced by eliminating multiple additional charges, such as the GETFund and NHIS levies, which currently inflate final costs.

“Our VAT Amendment Bill will fix the inefficiencies in the current system,” he told lawmakers.

Flat Rate VAT Scheme Scrapped

The widely criticized VAT Flat Rate Scheme will also be scrapped. The system, often blamed for compliance difficulties, has added complexity to small business operations.

Support for Small and Micro Businesses

In a key move for the informal sector, the VAT registration threshold will be raised. This means more micro and small traders will be exempted from VAT obligations.

Dr Forson explained that this measure would boost informal sector growth and ease tax compliance burdens.

Broad Consultation Underway

Consultations have already begun with stakeholders. The Ghana Revenue Authority (GRA) and the Ministry of Finance are engaging traders, business owners, and civil society across the country.

The government plans to submit the VAT Amendment Bill to Parliament in October as part of the 2026 Budget Statement.

Improving Compliance and Tax Fairness

To complement the reforms, the government plans to roll out fiscal electronic devices nationwide. This digital approach will:

- Enhance transparency

- Curb tax evasion

- Boost revenue collection

Dr Forson added that public education campaigns will also be launched to help businesses understand the changes.

“These reforms are designed to increase revenue without overburdening Ghanaians,” he said.

Takeaway Message

Ghana’s new tax reform package aims to balance fairness, simplicity, and business growth. By scrapping the COVID-19 levy and revising VAT policies, the government seeks to revive the economy, support small businesses, and enhance tax compliance without hurting consumers.